If central government increased taxes at a rate greater than inflation every year for 20 plus years – there would be rioting in the streets – but that is what central government encourages local governments to do – every year.

As the country’s demographics change and the population ages, new thinking by councillors and most importantly, central government is urgently required.

As rates increase faster than the ability of the elderly (65+) on fixed incomes to accommodate those increases – so the need for reform increases. It is now an

existential issue for the elderly and the “not so well off”.

There are however, easy solutions to address this rapidly emerging problem.

The problem:

The elderly have often lived in their privately owned homes for many years.

The council assessed value of homes has increased exponentially for 30+ years – well exceeding the rate of inflation.

Many elderly residents are on a “fixed” income that once a year gets belatedly adjusted for inflation.

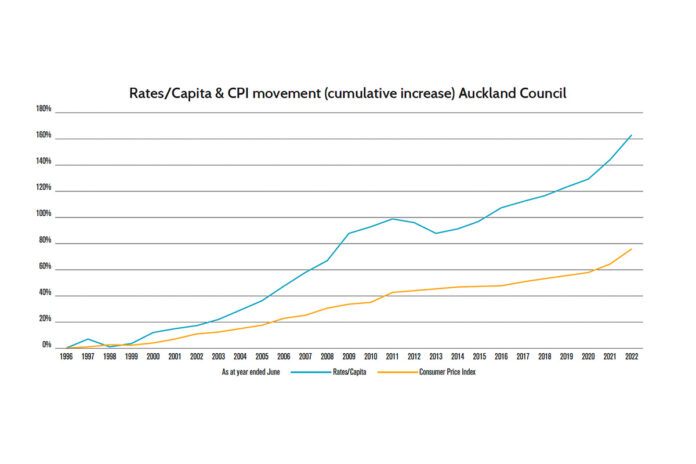

Rates increases such as have recently been imposed on us by councils are no longer sustainable. (See Graph)

Councils have always lacked the internal skills, inclination, or ability to address the issues – rather, they have always just elected to roll out the embedded system (The ATM Philosophy).

Proposed solution

Rates for the homes that elderly live in themselves should be set at no more than 10 percent of projected net after tax income for that ratepayer, each year.

For example: If Superannuation gives a $20,000 net income after tax – then rates (being another tax) are then set at no more than $2,000 (or about $40.00 a week).

Normal rates apply to any secondary properties owned – wherever they may be located.

It is worth noting that this proposal is not dissimilar to how student loan repayments are administered – i.e., as a percentage of that student’s income.

This would allow a better and more sustainable quality of life for those who are over 65 and have paid rates in Auckland for most of their working lives – or a significant portion of it.

It is also worth remembering that many in this demographic have also helped build Auckland’s infrastructure, maintain parks, and care for libraries and art galleries through years of full rates payments.

If a rate payer has lived in an area for say 15+ years and paid rates all that time, then they have clearly “paid their share”, but may well not live too long into the future and can therefore “pass the baton” on to the emerging rates paying demographic – who, incidentally, get to enjoy the fruits of their forebears’ labours (and their previous revenue contributions).

To fix the rates on a “value perception/guess” that council swings each three years is simply no longer acceptable, as it inevitably results in an inability to afford the rates bill.

Long-term residents who have bought their house many decades before and have therefore paid rates to cover the infrastructure build and maintenance (many times over most likely) will see value and logic in NOT being gouged by council as will all thinking observers.

Impact of downsizing

This must also accommodate where those elderly have recently “downsized” to a smaller or lower maintenance primary home, as they will have freed up their former primary residence for a family of full rate payers to occupy.

The smaller properties now occupied by the long term rates payers should also attract lower rates, so this also helps mitigate the damage to councils budgets – that will help ease the pain to council accountants.

The alternative is potentially “rioting in the streets” – many of us well remember Margaret Thatcher’s Poll Tax.

The only real issue is that council needs to understand and accept that this proposal deviates from rates based on property value only, to change to rates for over 65’s to be based on a percentage of total nett income.

To date income redistribution has been the role of central government – why can part of this re-distribution not fall to council rates, given that they are a tax on all homeowners also?

The elderly helped build this city – how about we receive some gratitude and empathy for our efforts to date and allow the next generation to both enjoy what has been achieved, and what will be achieved through a more fair and equitable rating solution for councils throughout New Zealand.

The only thing stopping this solution from being introduced, is the elected politician’s inclination to help their rate payers – as opposed to just maintaining the status quo supported by slow witted council accountants who will never voluntarily change their views.

It is time for change – and now is the time to help relieve the long-suffering rate payers.

To our elected representatives – “Over to you!”.

Ref: NZ Department of Statistics 01 August 2023