While the recent Official Cash Rate (OCR) cuts may be a relief for borrowers, it

signals falling term deposit rates. This is bad news if your nest egg is in a term deposit, especially if you rely on it for income.

This decline has left many investors seeking alternatives which balance risk and returns. While term deposits offer fixed interest rates and predictable returns, as the OCR continues to fall, they are looking less attractive.

Mortgage funds like First Mortgage Trust (FMT) present a compelling, relatively low-risk and flexible alternative. FMT lends money to commercial, residential and rural property owners, investors and developers secured by first mortgages with conservative loan-to-value ratios (LVRs).

Unlike term deposits, the returns from mortgage funds are not directly tied to the OCR, since the underlying loan rates align with market conditions, rather than the Reserve Bank’s monetary policy. This independence helps FMT to maintain our return premium over term deposits.

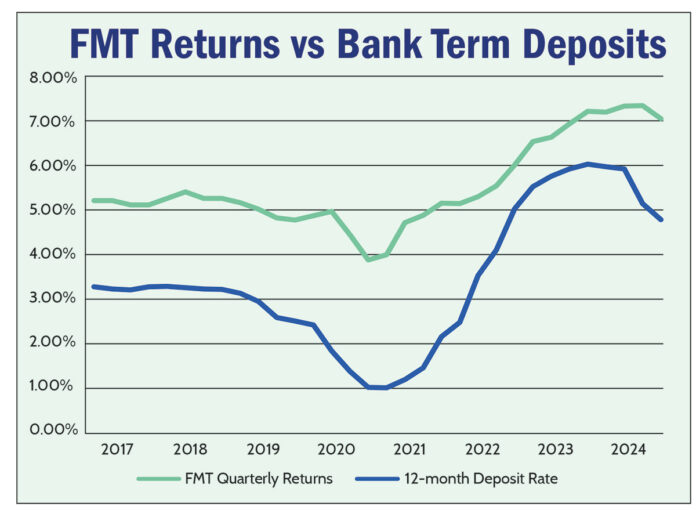

Even in a higher interest rate environment, FMT aims to provide an income return at a level better than bank deposits. While it cannot be assured, our goal is to give investors an annualised pre-tax quarterly return (after fees and expenses) of at least 100 basis points per annum higher than the average of the 12-month term deposit rates offered by New Zealand’s four main trading banks.

Our latest annualised pre-tax return for the December 2024 quarter was 7.14%. This is a notable achievement. With the average 12-month term deposit rate now at 4.64%, our return continues to demonstrate a significant premium – highlighting one of the key benefits of our fund.

Importantly, while there are meaningful differences between FMT and term deposits, this premium comes without significantly increased risk – FMT’s investments are diversified across more than 1,600 first mortgages with conservative LVRs. These are spread over a range of loans (residential, commercial, rural etc.) and geographical areas. This diversification gives FMT a markedly different risk profile to some property funds which offer small loan parcels or single loan investment options.

While no investment is without risk, FMT’s strategic approach and loan book diversification help mitigate these challenges for those looking to protect and grow their wealth.

Consider exploring which of FMT’s fund options – Retail, PIE or Wholesale (for wholesale investors only) – best aligns with your circumstances to secure a reliable source of income in a changing economic landscape.

Take the next step towards investing with peace of mind at fmt.co.nz

Phone: 0800 321 113

Email: team@fmt.co.nz

First Mortgage Managers Limited (FMML) is the issuer. FMML is licensed under the Financial Markets Conduct Act 2013 as a manager of registered schemes and is not a registered bank under the Banking (Prudential Supervision) Act 1989. For copies of the Product Disclosure Statements or the Wholesale Fund Investment Memorandum please visit our website, fmt.co.nz or contact us on 0800 321 113.